Whether you’re buying or selling, we want to make sure you have the most pertinent information, so we’ve put together this monthly analysis breaking down specifics about the market.

As we navigate the local market together, please don’t hesitate to reach out to us with any questions or concerns. We’re here to support you.

The Local Lowdown

Quick Takes:

-

We're seeing optimism return to the market after the Fed announced the biggest rate cut in years on September 18th. In anticipation of this news, banks began slashing rates, and now we are seeing rates as low as 4.625%. Ask us for an introduction to those lenders who have the best rates.

-

Inventory swelled after Labor Day, with nearly 700 new residential listings added since this month, compared to 257 listings added in all of August. Fall is our second busiest selling season, and we expect inventory to continue to rise through the end of October, when activity is expected to wane based on seasonal trends (and the upcoming presidential election - more on that, below).

-

The San Francisco median single-family home price fell about 3% from July to August, while condo prices declined 20.9% during that same period. With the market picking back up again, keep an eye out for next month's report which should showcase a very different story.

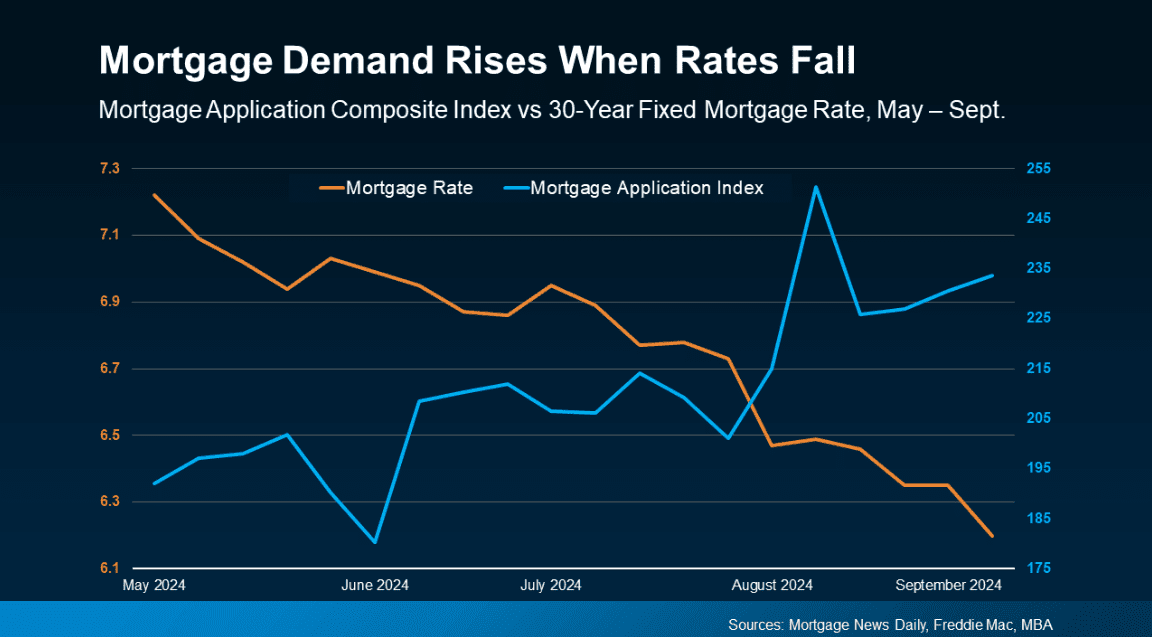

Mortgage Demand Rises When Rates Fall

It's been 1,650 days since the Federal Reserve last cut rates. During this era of rising rates, we've seen mortgage rates peak at nearly 8% in October 2023, existing home sales plummet to 1995 levels and home affordability hit a 40-year low. Lower mortgage rates will result in more buyers, increased competition, and likely more refinancing. But it could also lead to something more important: more homes hitting the market. According to a recent Bankrate survey, only a tiny fraction of homeowners — just 5% — feel comfortable selling their homes with mortgage rates at 6% or higher. The survey revealed that more than a third of homeowners (35%) would be willing to sell their homes if mortgage rates dip below 6%. More homes hitting the market should lead to a healthy and stable real estate market.

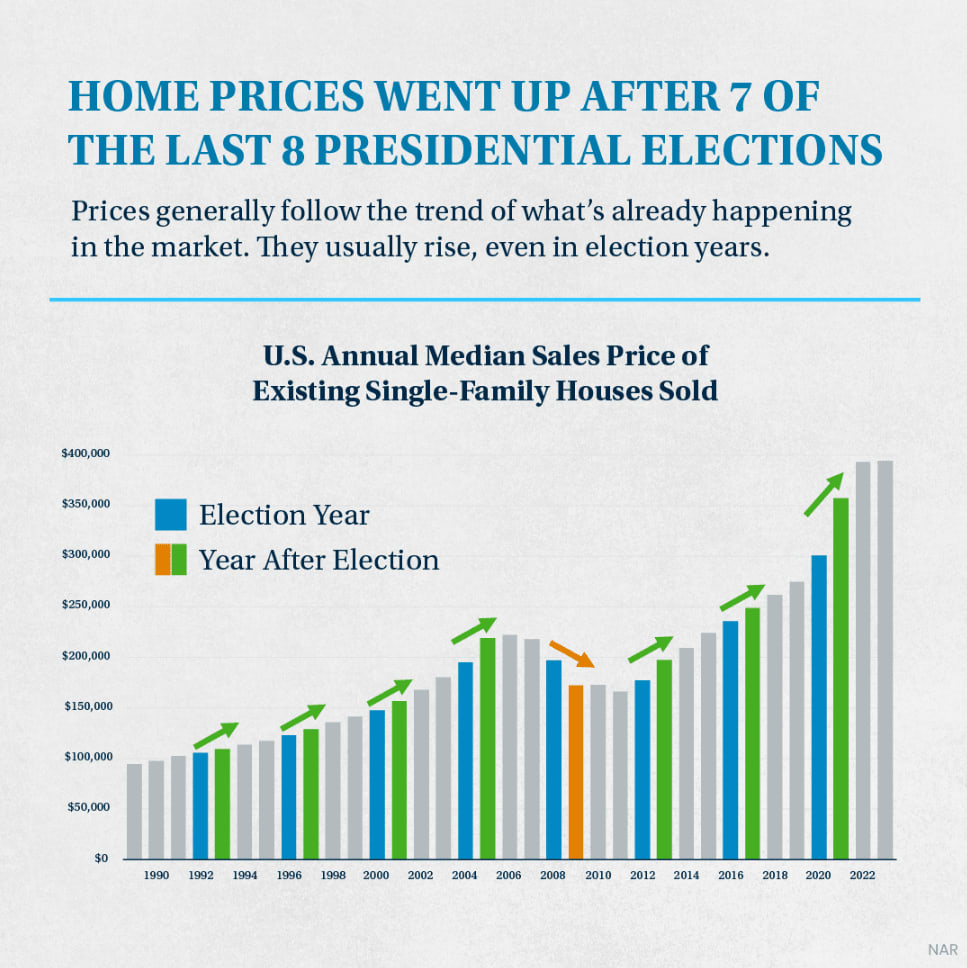

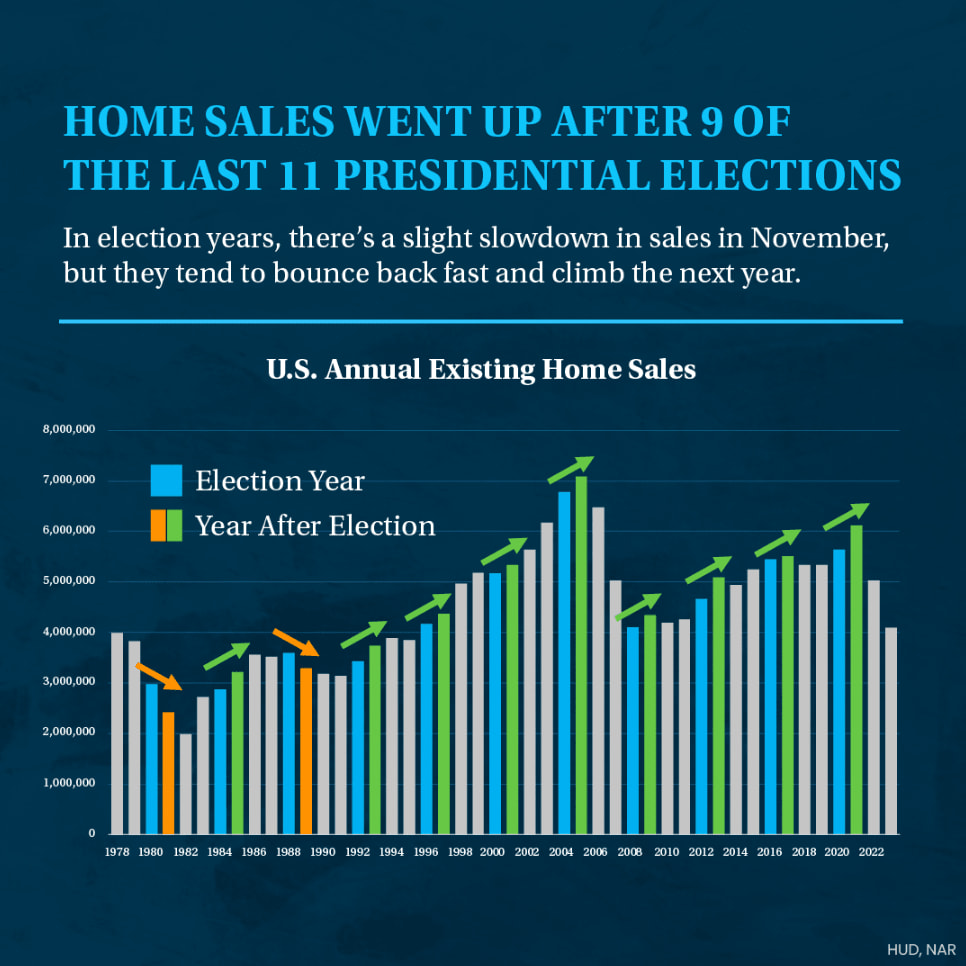

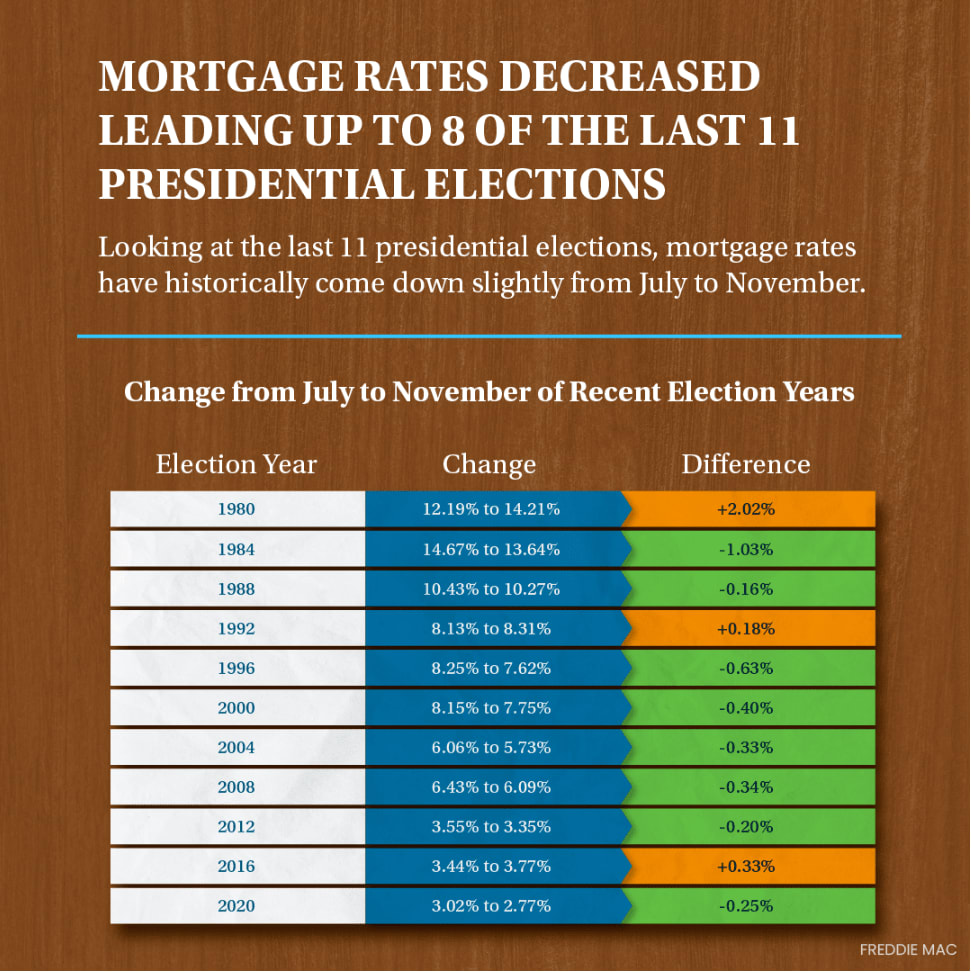

What to Expect after the Presidential Election

Wondering if the upcoming Presidential election will shake up the housing market?

Here's what you need to know: History shows home sales may slow down a bit in November, but they usually bounce back fast, prices keep climbing, and mortgage rates tend to dip a bit.

Overall, the impact is minor and short-lived. Have questions? Let's chat.

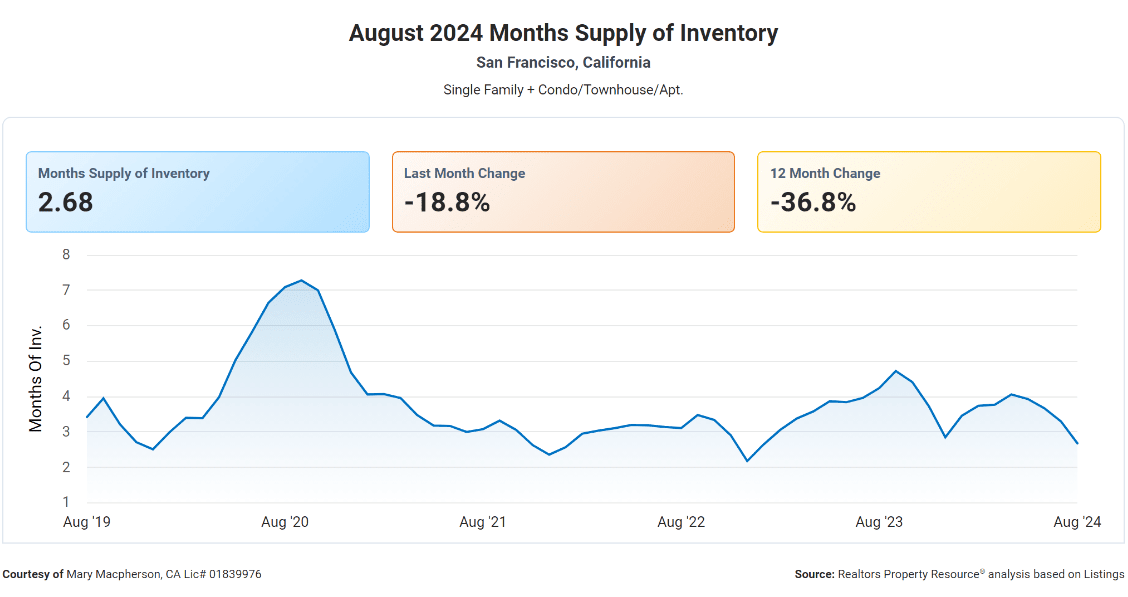

Months of Supply Inventory in August 2024 indicated a sellers’ market for single-family homes and a buyers’ market for condos

Months of Supply Inventory (MSI) is a metric that indicates the supply and demand dynamics in the housing market. In San Francisco, MSI has been low, especially for single-family homes, signifying a strong seller's market. Although MSI has decreased recently, it still points to a seller's market for single-family homes and a buyer's market for condos.

The Bigger Picture

We will soon see how things shake out this fall with more inventory, lower rates and more overall sales activity. If you're considering a purchase or a sale, our advice is simple: consider all of your options, and please ask us for a free comprehensive market analysis. We're always here for you.