The Big Story

Sellers are coming back to the market

-

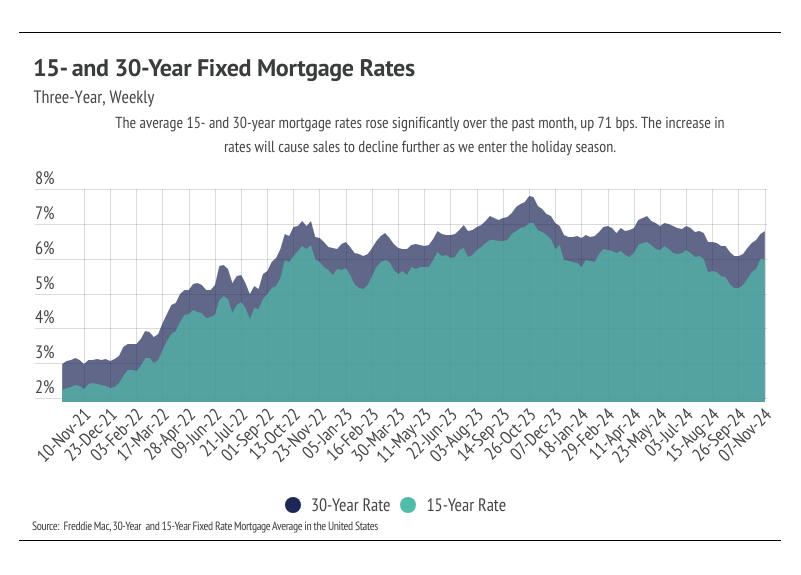

After the election of Donald J. Trump, bond prices increased in anticipation of his inflationary policy positions. Interest rates are the most significant factor financially in purchasing a home for most buyers, and as we’ve seen over the past two years, higher rates translate to lower sales.

-

From October 1 – November 7, the average 30-year mortgage rate rose 71bps, landing at 6.79%. The Fed cut rates by 50 bps in September and another 25 bps during the Fed’s November 6-7 meeting.

-

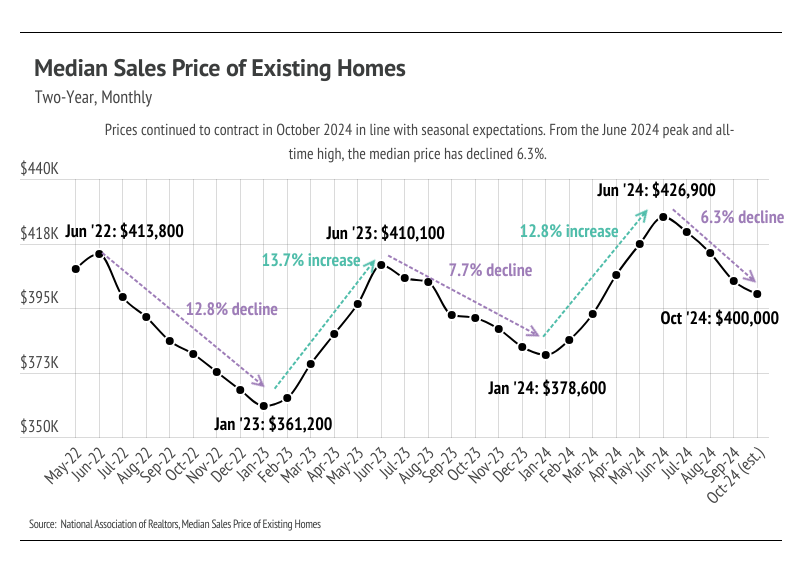

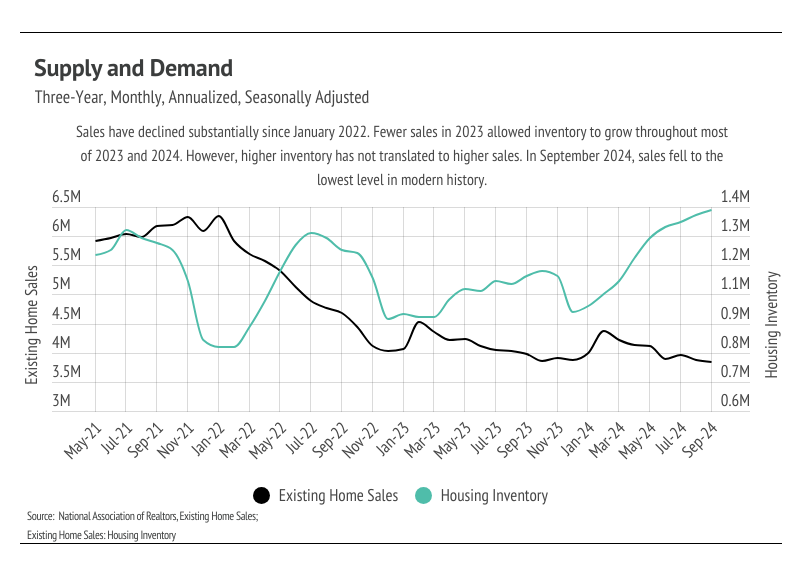

Sales declined 1.0% month over month, falling to the lowest level in modern history, while inventory rose to its highest level since 2020. The spike in mortgage rates should further slow the market in the winter months.

Bond and mortgage rates are rising as the Fed is cutting rates.

Big Story Data

The Local Lowdown

-

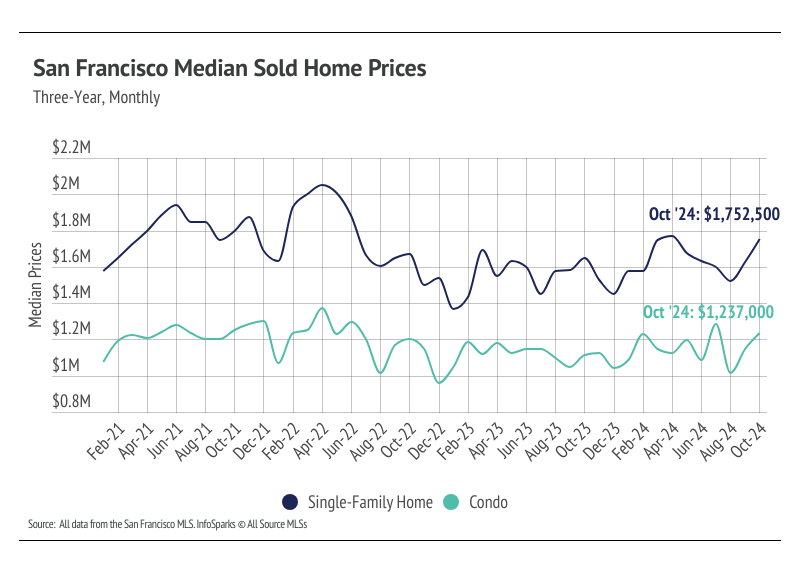

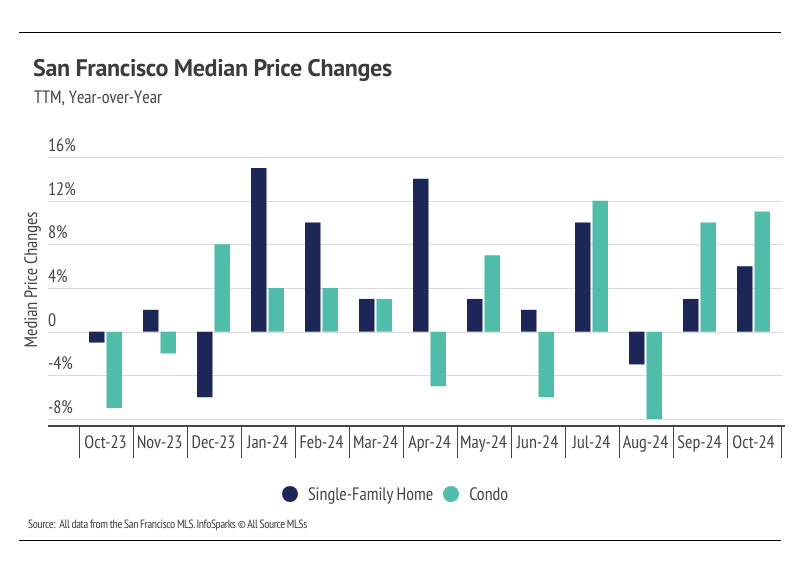

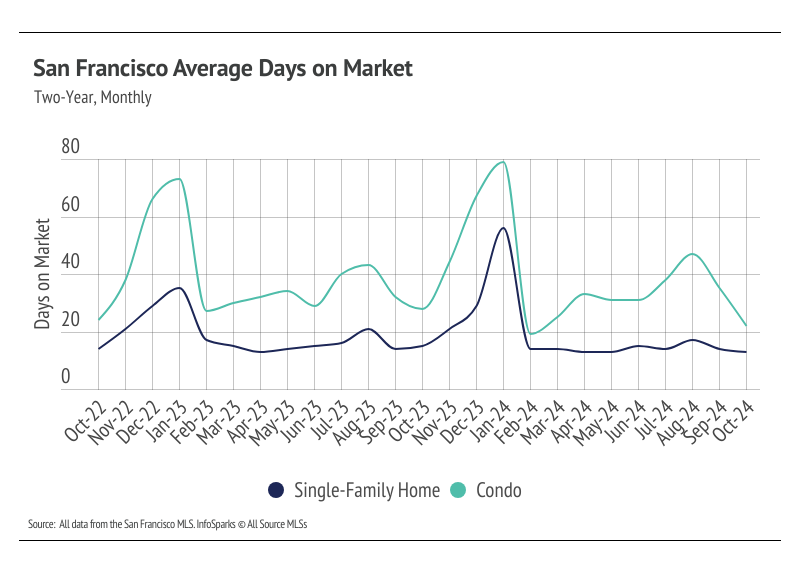

The median single-family home price rose 7.7% month over month, while condo prices increased 9.2%. We expect prices to contract over the next three months, which is the seasonal norm.

-

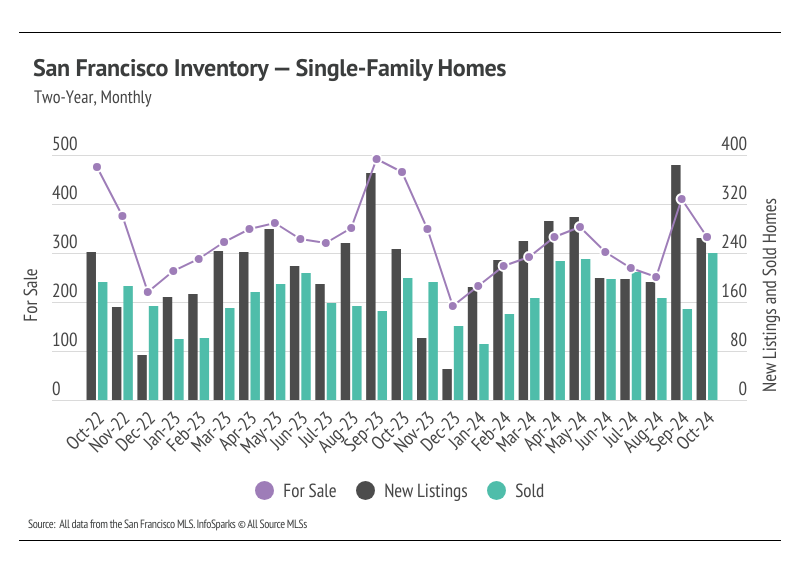

Total inventory declined 11.0% month over month, as new listings declined and sales spiked, which is common for San Francisco in October. We expect inventory to decline and the overall market to slow through January 2025.

-

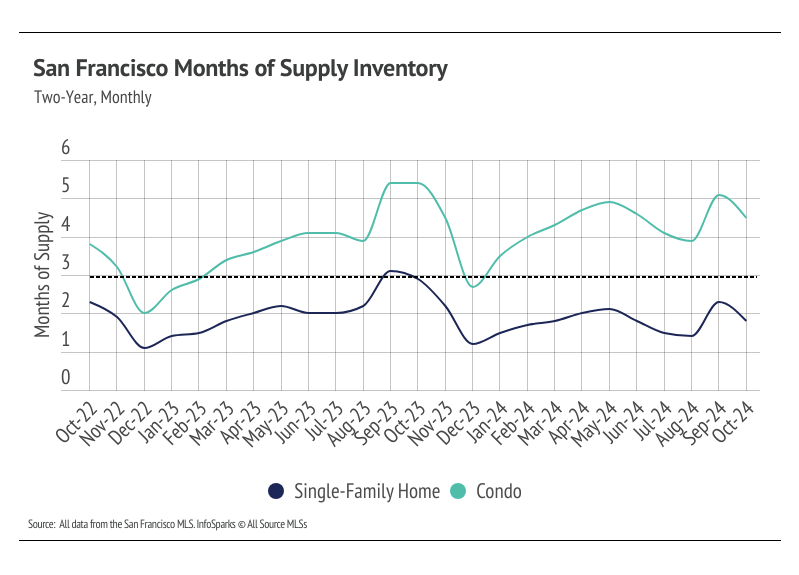

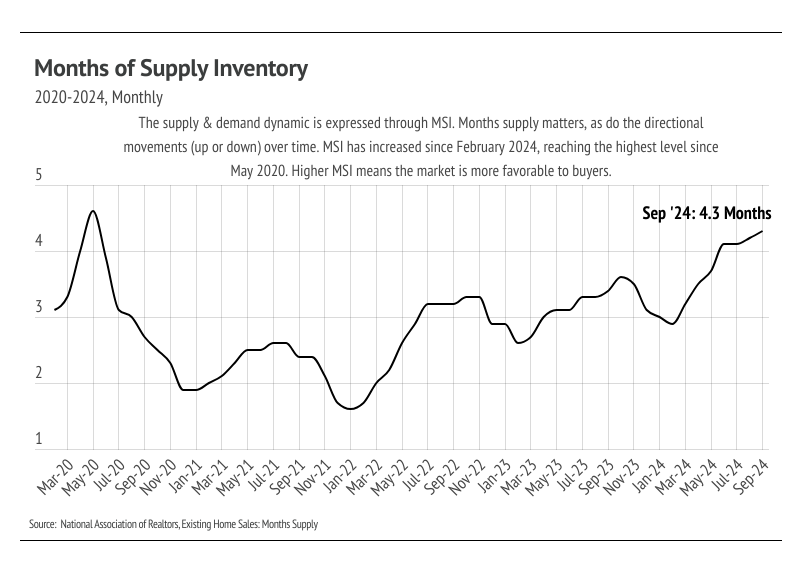

Months of Supply Inventory declined in October. Currently, MSI remains under three months of supply for single-family homes, indicating it’s still a sellers’ market, while condo MSI continues to indicate a buyers’ market.

Median home prices increased month over month and year over year

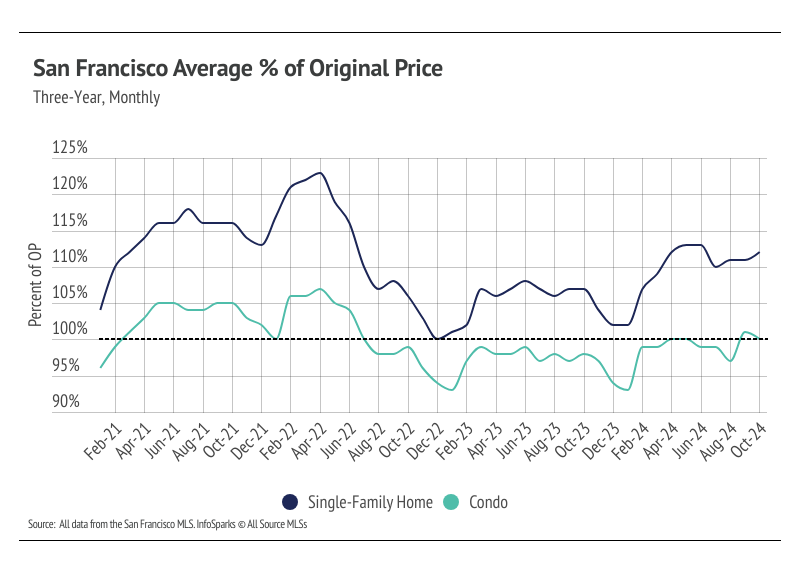

In San Francisco, home prices haven’t been largely affected by rising mortgage rates after the initial period of price correction from April 2022 to August 2022. Single-family home prices peaked at $2.05 million in April 2022 as mortgage rates rose rapidly; $2 million homes are simply far more affordable with a 4-5% mortgage than a 6-7% mortgage. Because of the relatively high prices of homes in San Francisco, prices had to come down to keep buyers in the market. Since August 2022, the median single-family home and condo prices have hovered around $1.6 million and $1.1 million, respectively. Year over year, the median price was up 6% for single-family homes and 12% for condos. More sellers came to the market in September and buyers rushed in, pushing up prices. Inventory is so low that rising supply only increases prices as buyers are better able to find the best match.

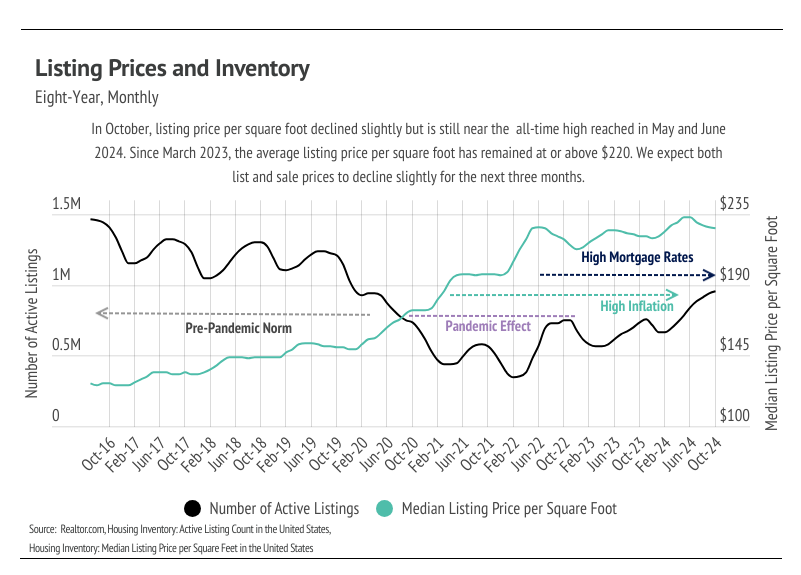

High mortgage rates soften both supply and demand, but home buyers and sellers seemed to tolerate rates near 6% much more than around 7%. Mortgage rates fell significantly from May through September, but rose significantly in October. Now, rates are far closer to 7% than 6%, so we expect sales to slow starting in November.

Sales spiked in October, while inventory and new listings fell

In October, sales spiked, following the September surge in new listings. New listings nearly doubled from August to September, largely contributing to the 52% increase in sales from September to October. In San Francisco, a significant number of new listings tend to hit the market in January and September in any given year. Compared to this time last year, sales are up 18%, while inventory is down 13%.

Total inventory has trended lower essentially since 2010, but active listings fell precipitously from October 2020 to December 2021, as sales outpaced new listings, before stabilizing to a degree from January 2022 to the present at a depressed level. Low inventory and new listings, coupled with high mortgage rates, have led to a substantial drop in sales and a generally slower housing market. Typically, inventory begins to increase in January or February, peaking in July or August before declining once again from the summer months to the winter. In 2023, sales didn’t resemble the typical seasonal inventory peaks and valleys. It’s looking like 2024 inventory, sales, and new listings will follow historically seasonal patterns, albeit at a depressed level. Supply will remain tight until spring 2025 at the earliest

Months of Supply Inventory in October 2024 indicated a sellers’ market for single-family homes and a buyers’ market for condos

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The San Francisco housing market tends to favor sellers, which is reflected in its low MSI, at least for single-family homes. MSI has been below three months since October 2023 for single-family homes. From May to August, MSI declined meaningfully. In September, MSI jumped significantly higher as new listings spiked. However, in October, sales jumped and MSI fell. Currently, condo MSI indicates a buyers’ market, while single-family home MSI still implies a sellers’ market.