San Francisco’s chronic inventory shortage reasserted itself in Q4, just as serious buyers returned to the market. A steadier rate environment, renewed confidence in the city, and continued AI capital flowing into the region combined to reignite demand – especially for well-located, thoughtfully prepared homes. The result: multiple offers, faster timelines, and pricing power for sellers who got it right.One recent Vantage listing in the Inner Sunset became a clear signal of the shift. With minimal prep – a light refresh, fresh paint, and strong staging – we priced the home at $1,995,000 and received 10 offers within its first week, closing at 31.6% over list. We’re also seeing more sellers loosen their grip on sub-4% mortgages, testing the market and finding that conditions are increasingly working in their favor.Looking ahead (with the appropriate humility – no crystal balls here), the fundamentals point to continued strength into 2026: disciplined, well-capitalized buyers eager to escape high rents; sellers regaining confidence after a long pause; and interest rates holding within a range that supports activity rather than stalling it. Momentum, once again, is being driven by confidence – and confidence is building.

Zoning Changes and Development Proposals Signal a Policy Shift

The debate surrounding Align Real Estate’s proposed Safeway redevelopments – from the Fillmore and Bernal Heights to the Outer Richmond and now the Marina – highlights a meaningful shift in San Francisco’s housing policy landscape. The Marina proposal alone envisions a 25-story building with 790 homes, including 86 affordable units, made possible by state housing laws that allow denser development along neighborhood commercial corridors, even amid local opposition.This debate is unfolding alongside the city’s adoption of Mayor Daniel Lurie’s new Family Zoning Plan, which up-zones large portions of San Francisco – particularly on the north and west sides – by permitting taller, denser housing in areas historically constrained by low height limits. Taken together, these developments reflect a clear policy direction: expanding housing capacity to address a historic supply shortage and comply with state mandates, while ongoing concerns about neighborhood character and displacement continue to shape the public conversation.Safety Mandates Add Complexity to Housing Challenges

San Francisco’s housing debate is further complicated by renewed scrutiny of safety mandates, including the city’s fire sprinkler retrofit requirement and the newer state Exterior Elevated Elements (EEE) rules governing inspections and repairs for balconies, decks, and stairways. Condo owners and homeowner associations argue that the combined cost of compliance could place a significant financial burden on owners of older buildings, potentially affecting housing stability and accelerating displacement.City leadership has signaled openness to extending deadlines and exploring cost-relief options, while fire safety advocates maintain that both measures are essential to preventing catastrophic failures and protecting lives. These parallel debates underscore a central challenge facing San Francisco: how to modernize and safeguard an aging housing stock while preserving affordability and long-term viability.Current Mortgage Rates

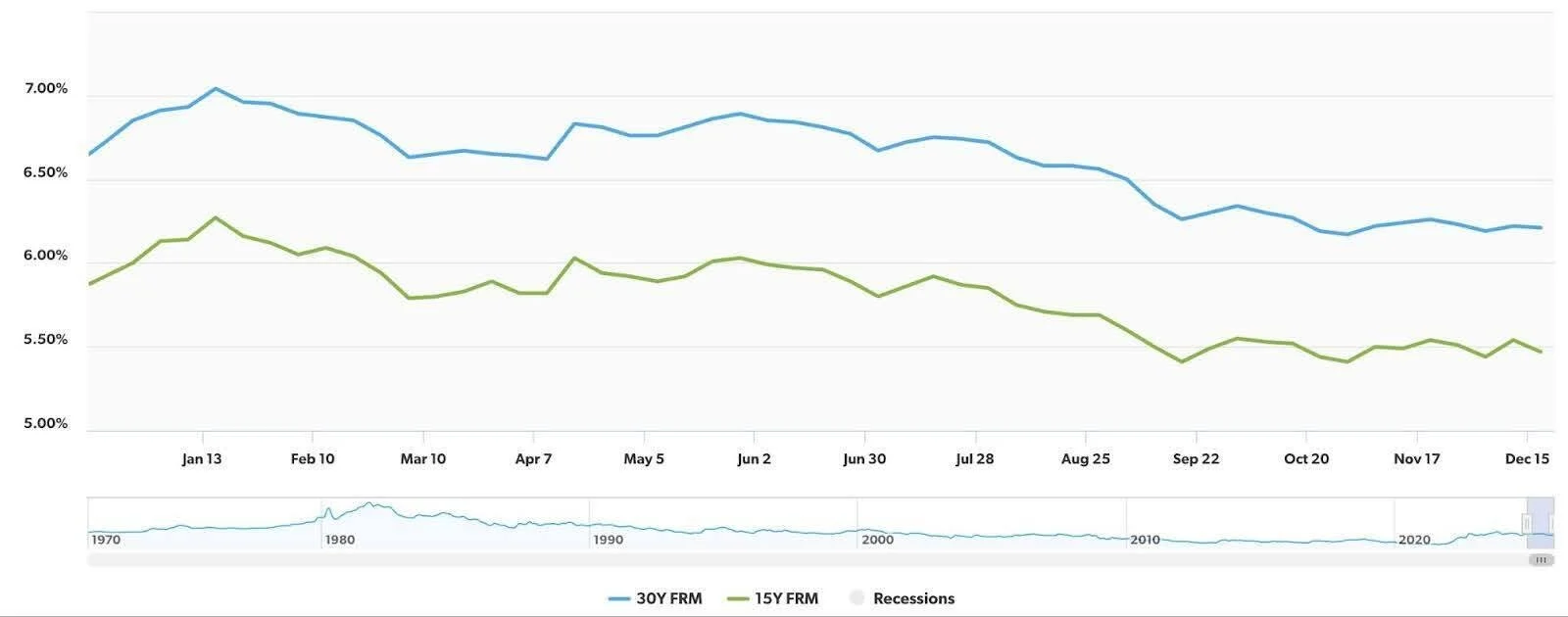

The 30-year fixed-rate mortgage sits at 6.21% for the week ending December 18, 2025, while the 15-year fixed-rate mortgage is at 5.47%, numbers slightly below where they were last year at this time (6.24% and 5.49%, respectively). (Freddie Mac)

Renting Versus Buying

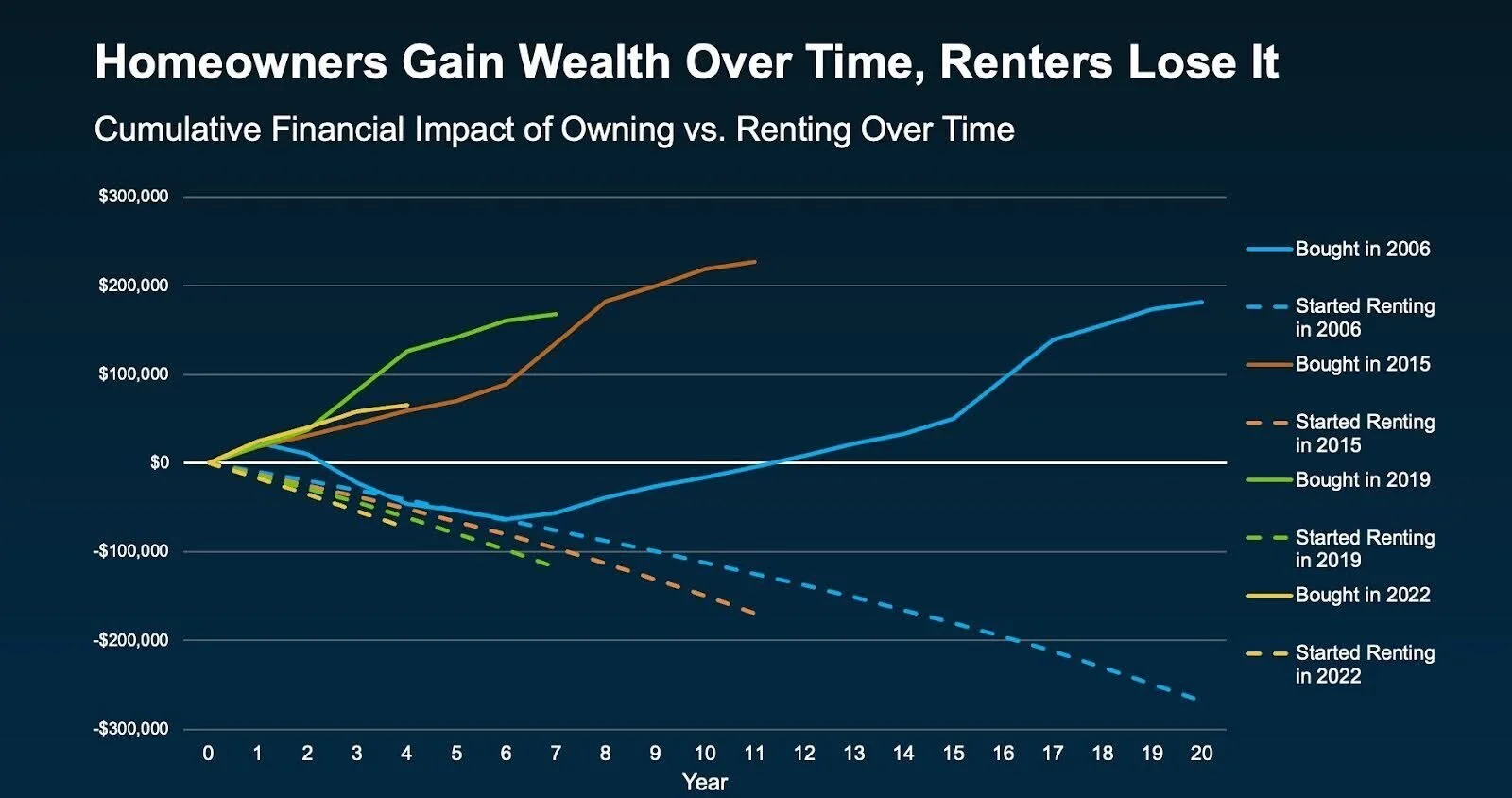

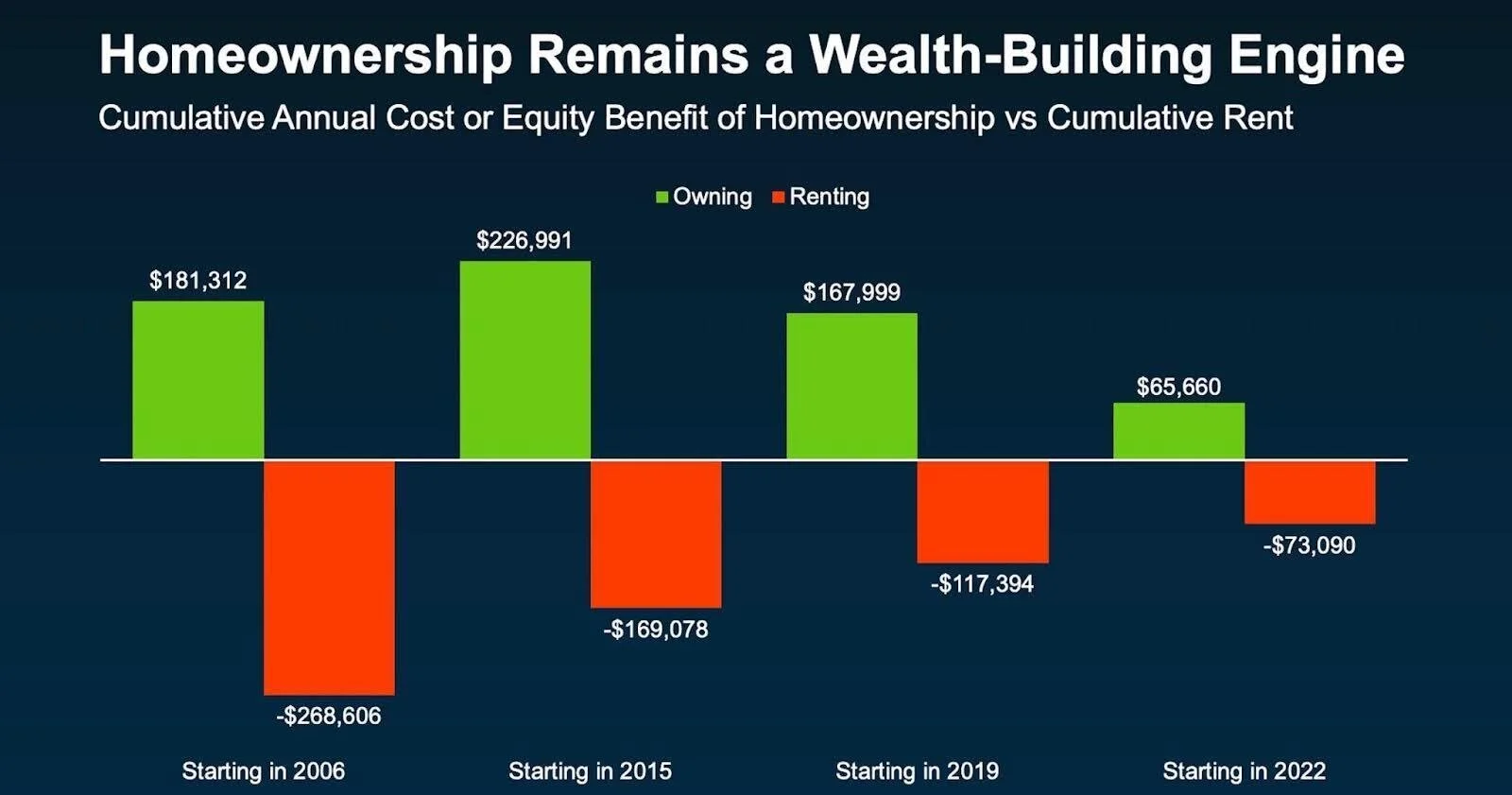

These next two charts tell a familiar story: homeowners build wealth over time, while renters steadily fall behind. Whether you bought in 2006, 2015, 2019 – or even as recently as 2022 – ownership has historically rewarded patience through appreciation, principal paydown, and rent replacement. Renters, meanwhile, face rising costs with no equity to show for it. The takeaway isn’t about timing the market perfectly – it’s about participating in it. (First American)

Renters Coming off the Fence

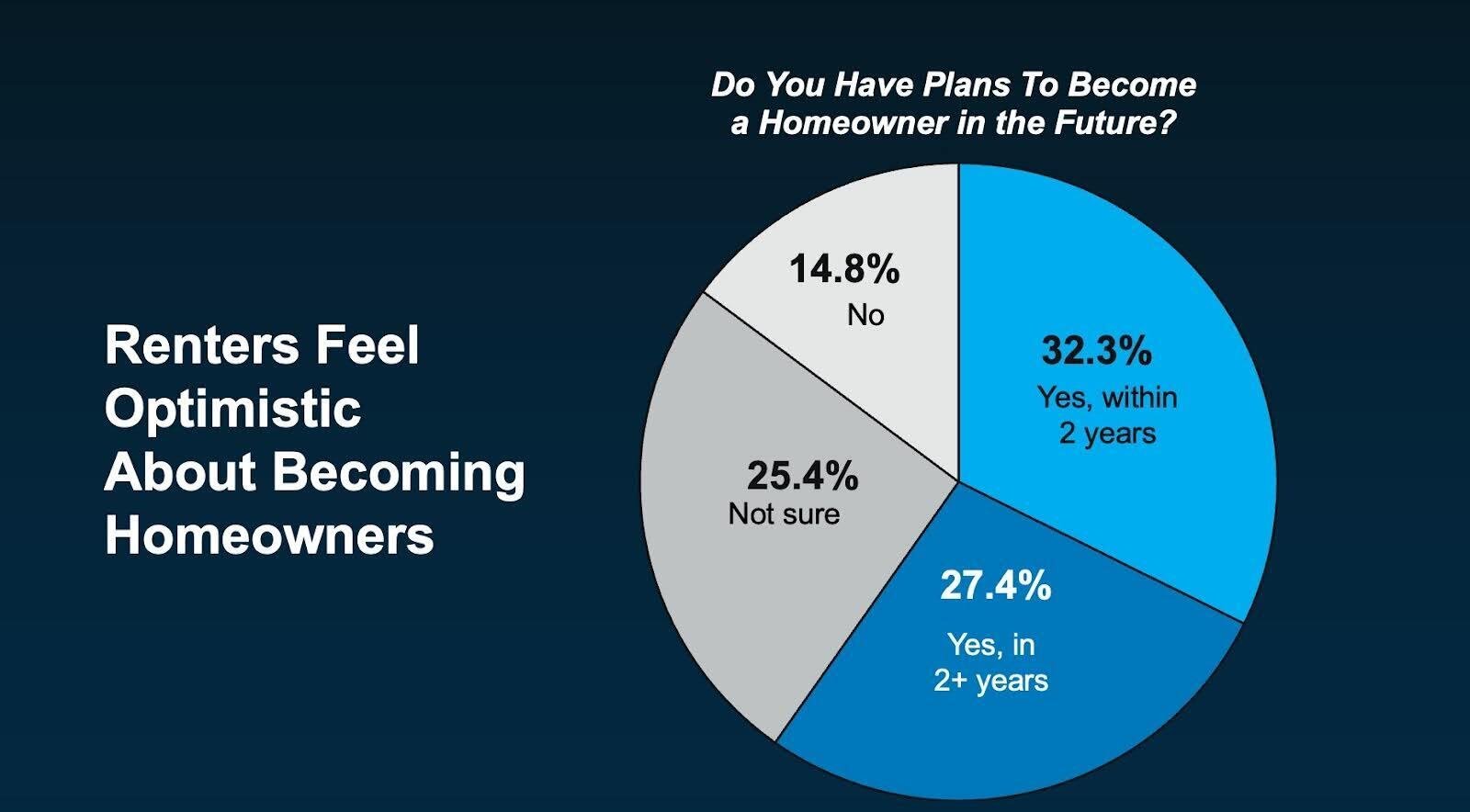

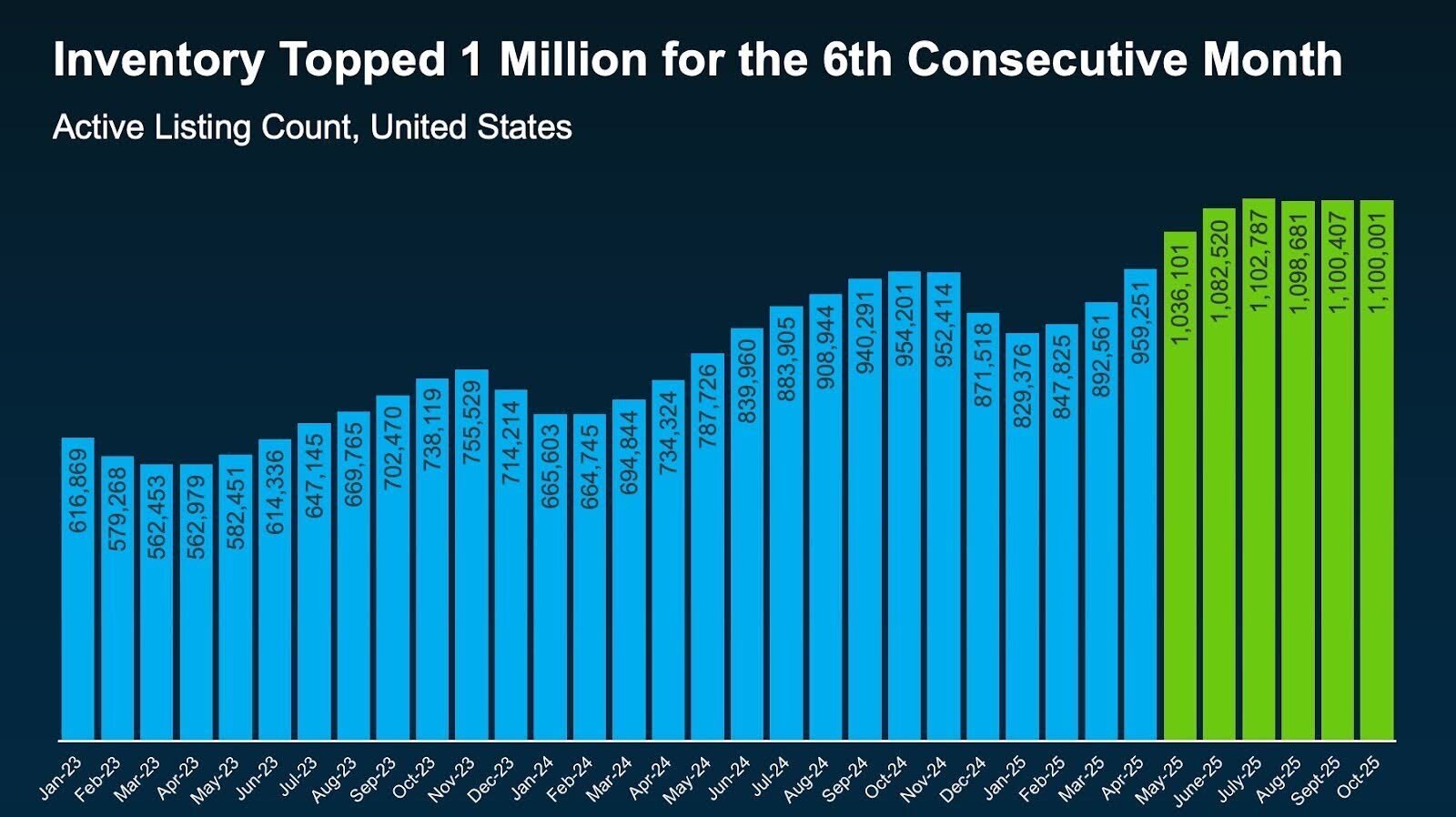

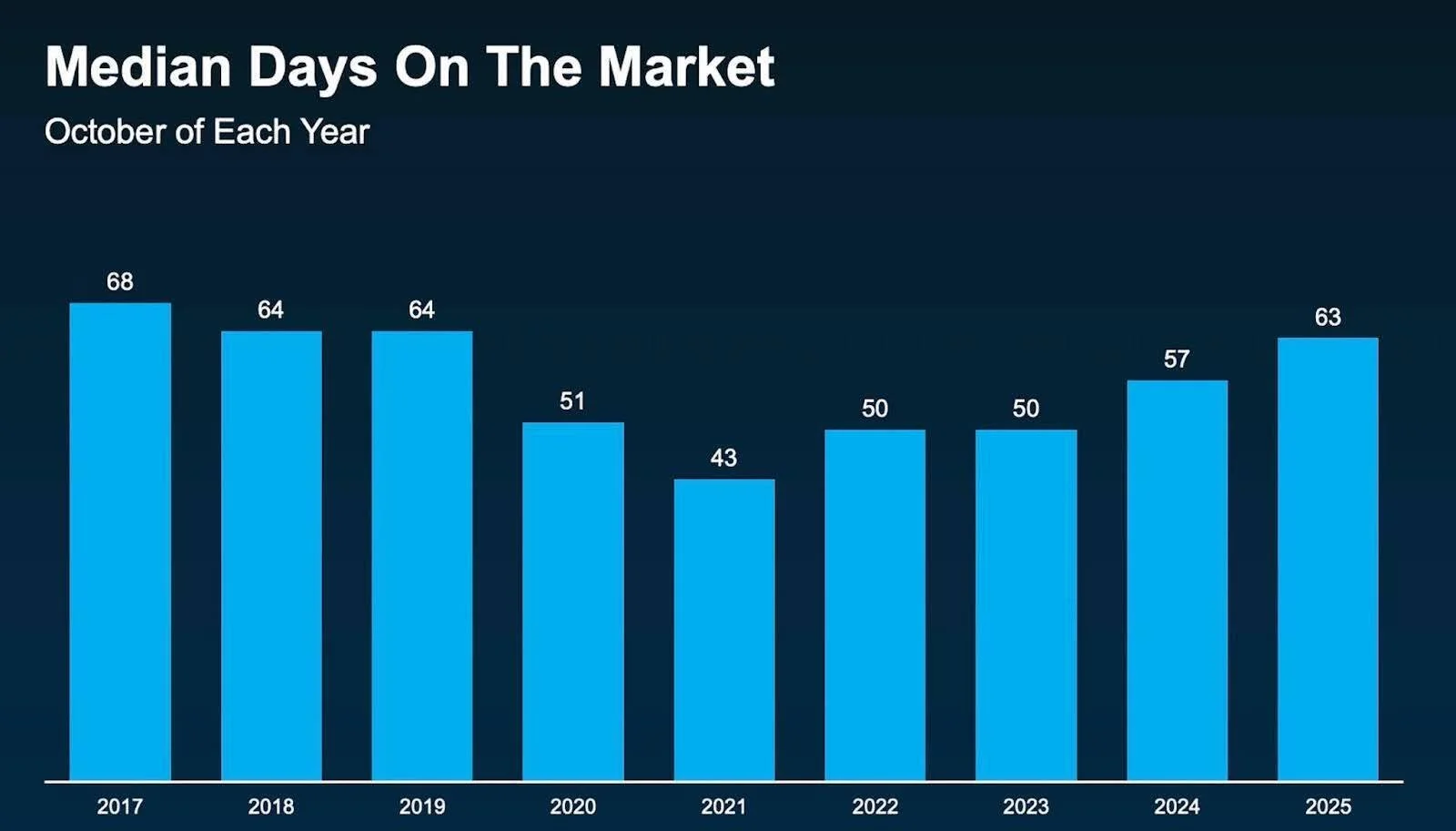

Nationally, renters are feeling more empowered to take the homeownership path. Unlike what we’re seeing in San Francisco, inventory has been rising nationally with more homes on the market than we’ve seen since 2019. This rise in inventory puts upward pressure on days on market, downward pressure on prices, and has created a more welcoming atmosphere for buyers than we’ve seen since before the pandemic. Optimism is starting to build and buyers are back to buying. (Realtor.com)

San Francisco Market Snapshot: November’s Numbers Tell a Very Local Story

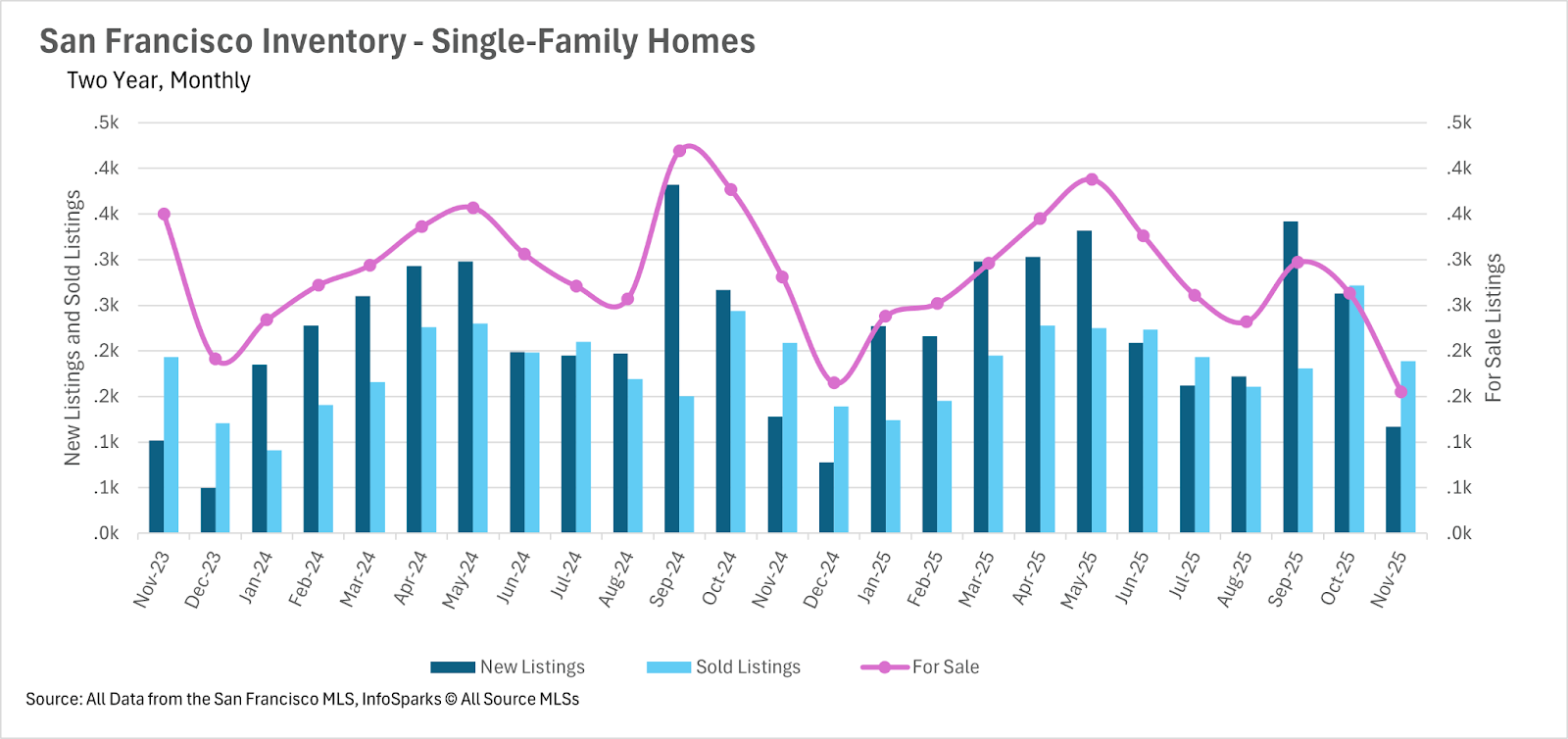

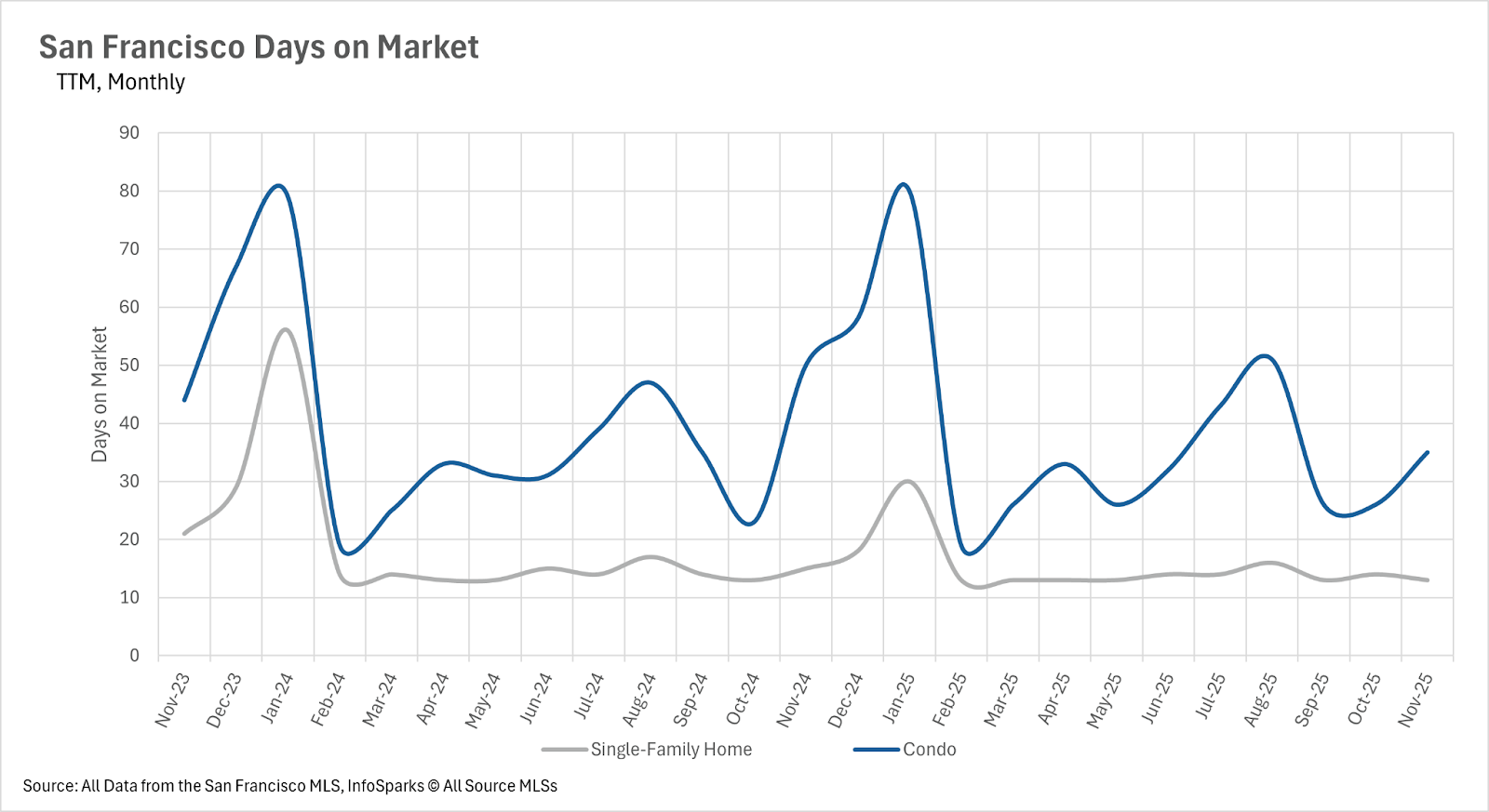

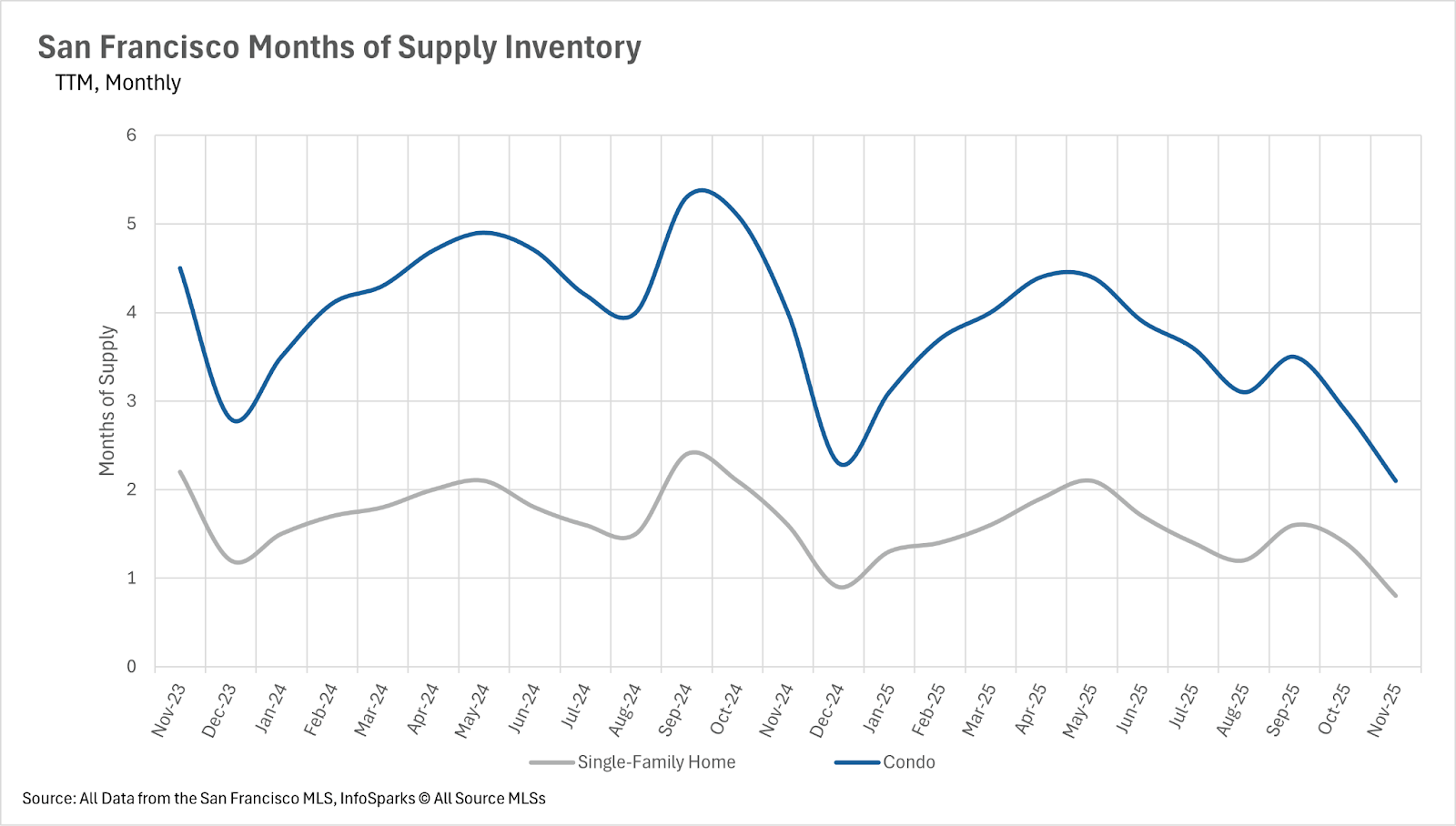

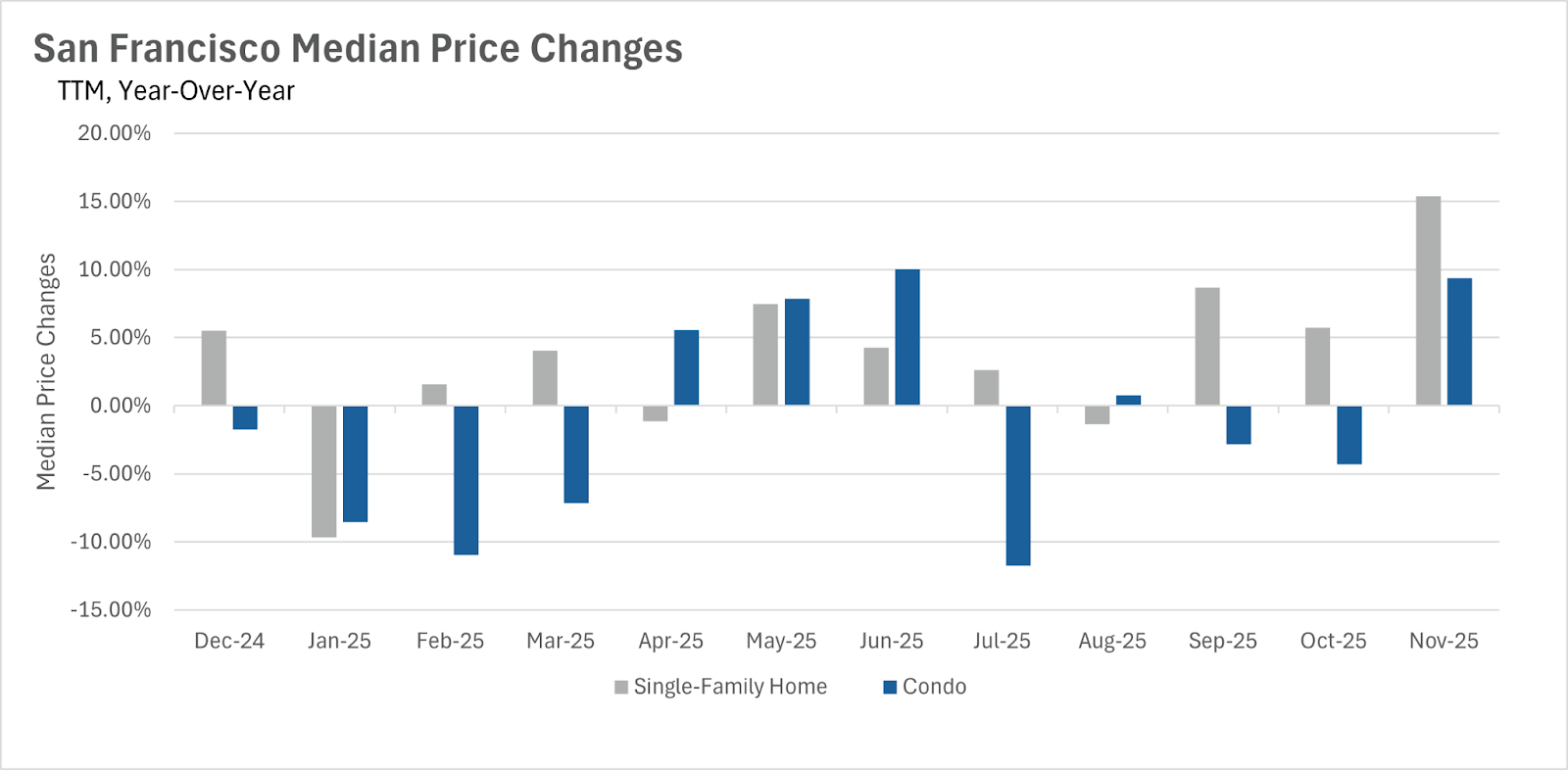

November delivered a surprising twist in San Francisco real estate. While we typically see prices cool after October, this year the slowdown never came. Instead, median sale prices climbed sharply year over year, underscoring just how constrained – and competitive – our local market has become.Single-family home prices rose 15.82% year over year, while condo prices increased 9.36%. Even more telling, homes are selling at the highest premium we’ve seen in three years, with the average single-family property closing at 16% over the original asking price. Buyers are clearly out in force, and well-priced, well-presented homes are being rewarded quickly.That competition is being fueled by a dramatic shortage of inventory. At the end of November, there were just 553 homes for sale across all of San Francisco (and, as of this publication, just 95), marking the lowest inventory levels we’ve seen in the past three years. Compared to last November, single-family inventory is down 44.84%, and condo inventory has fallen 41.90%. This is especially notable as we head into December, when listings typically thin out even further. While future rate cuts could eventually encourage more sellers to enter the market, for now, supply remains extremely tight.With fewer homes available, listings are being snapped up at a rapid pace. The average single-family home is selling in just 13 days, a 13.33% decrease from last year. Condos are also moving faster, averaging 35 days on market, down 30% year over year. For buyers, this means decisions must be made quickly – there’s little time to “wait and see” in today’s environment.All of this firmly places San Francisco in seller’s market territory. Using the Months of Supply Inventory (MSI) metric, a balanced market typically sits around three months. Today, San Francisco has just 0.8 months of supply for single-family homes and 2.1 months for condos, signaling a deeply entrenched seller’s market citywide.The takeaway: pricing power has shifted back to sellers, competition is intense, and inventory remains the defining story of our local market. As we head into year-end, these dynamics are setting the stage for a very active start to the new year – especially for homeowners considering a move and buyers prepared to act decisively.San Francisco Prices Rebound Strongly into Year-End

After a volatile start to the year, San Francisco home prices surged in the second half of 2025. By November, single-family home prices were up 15.82% year over year, while condo prices also posted a solid 9.36% annual gain – a notable shift for a market that typically cools this time of year. Tight inventory and renewed buyer confidence continue to drive pricing power across the city. (NorCal MLS Alliance, InfoSparks)

San Francisco Inventory Hits Multi-Year Lows as Homes Sell at Record Speed

San Francisco’s inventory crunch has reached an inflection point. At the end of November, there were just 553 homes for sale citywide, marking the lowest inventory levels we’ve seen in more than three years – and heading into December, when supply typically tightens even further, we now have less than 100 homes for sale. On a year-over-year basis, single-family home inventory is down 44.84%, while condo inventory has fallen 41.90%, underscoring just how constrained the market has become.As supply continues to shrink, demand is absorbing listings at a breakneck pace. Single-family homes are now selling in just 13 days on average, a 13.33% year-over-year decline, while condos are averaging 35 days on market, moving 30% faster than last year. For buyers, this means decisiveness is no longer optional – homes are being claimed quickly, often before there’s time to pause. Until more inventory comes online, this dynamic is unlikely to ease, though future rate cuts could eventually coax sidelined sellers back into the market. (NorCal MLS Alliance, InfoSparks)